By: Terri Scheuermann

It’s August, and you have completed the CAMAvision Year-End processes. If you have not completed it and need a little guidance, you can click on the following link for the CAMAvision Timeline document: http://www.camavision.com/handouts/2017ugm/IA_Camavision_timeline2017.pdf

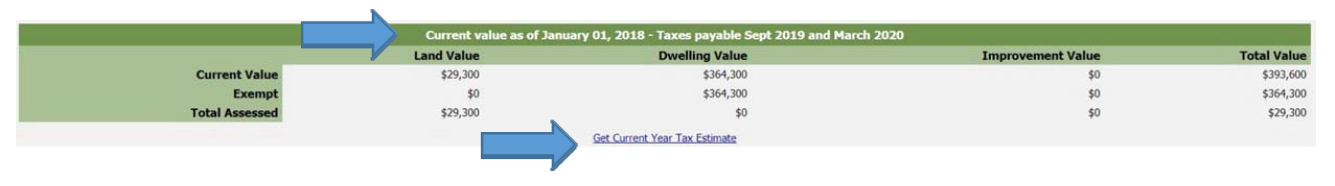

It’s now time to be sure you have a few website options updated. We will first look at updating the Special Value Header. This header is specific to your Vanguard website as no other vendor has a more helpful feature for the public. There can be no mistake as to what the displayed value really means.

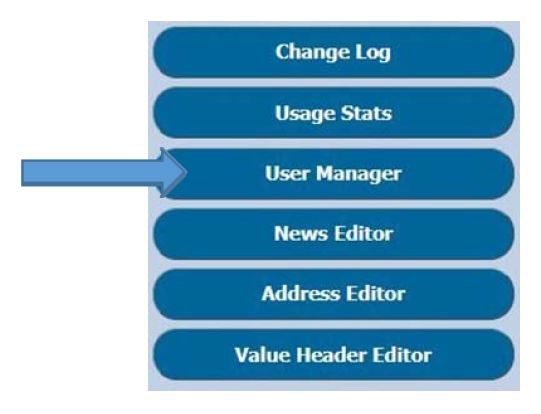

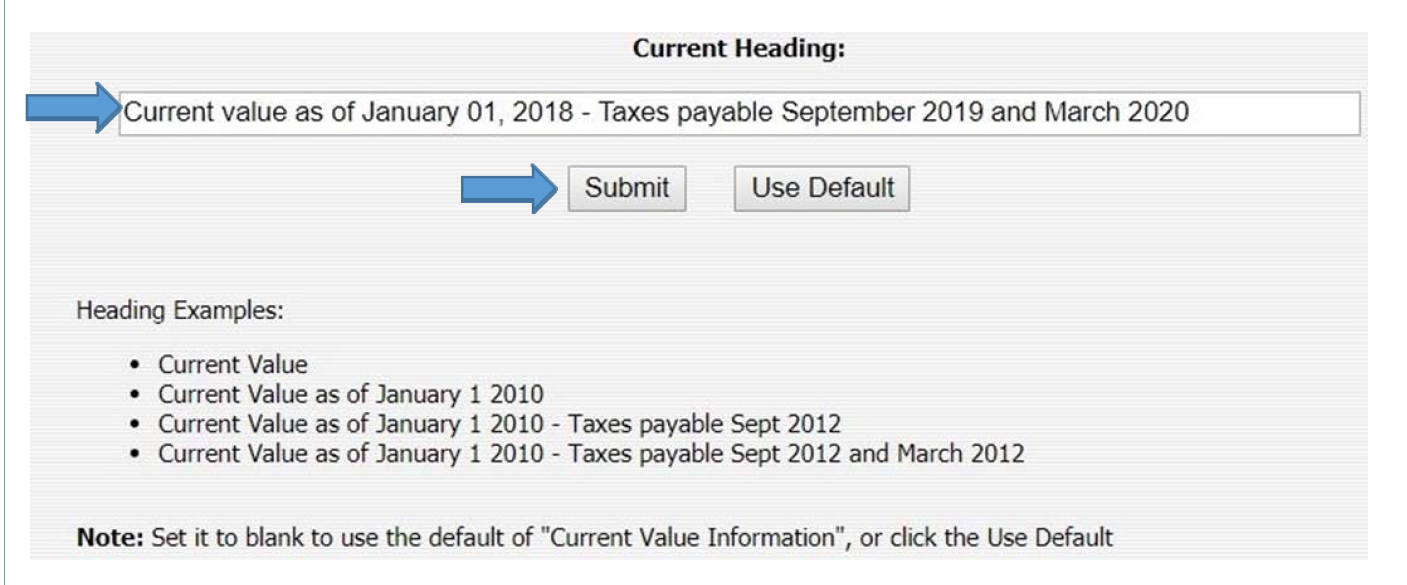

After you Log in to your Website with your Admin login select the Value Header Editor button.

The above editor is displayed. You could then copy any one of the Heading Examples, paste onto the Heading field, and change the dates. Be sure to select Submit to save the change. It’s that simple.

After the County/City Auditor has calculated new levies and the state has decided on Homestead, Military and BPTC credit amounts, it would be time to update the Get Current Year Tax Estimate figures.

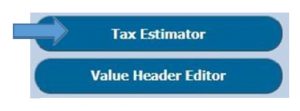

After you Log in to your Website with your Admin login select the Tax Estimator button

After you Log in to your Website with your Admin login select the Tax Estimator button

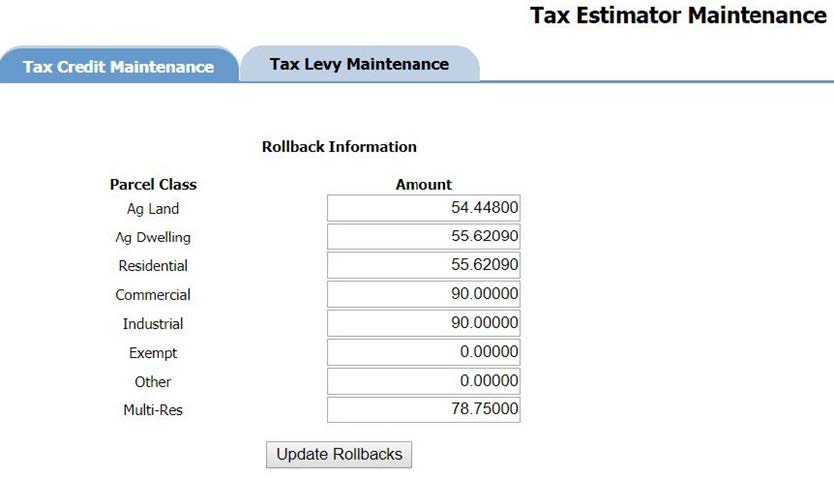

The Tax Estimator Maintenance screen is displayed. The Tax Credit Maintenance tab allows for editing the Rollback for each class of property. Be sure and select the Update Rollbacks button when finished to save the changes.

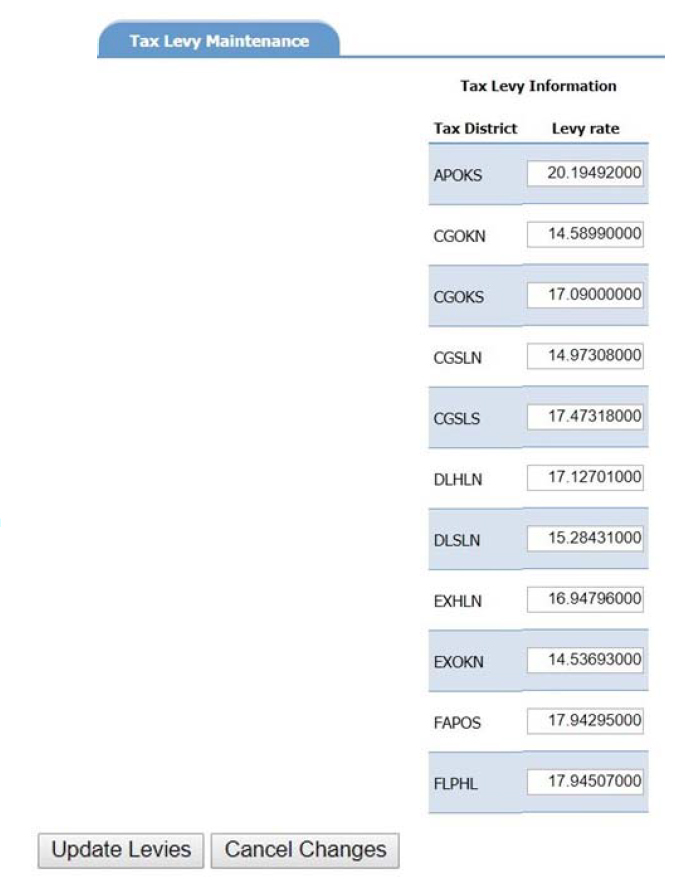

The Tax Levy Maintenance tab allows for editing the tax levy rate for each school/tax district as is shown in your CAMAvision School/Tax District table located in the General Table Main Menu option.

Be sure and select the Update Levies button to save the changes. Or you may select the Cancel Changes to revert back to the original levy rates.

As always for any questions please feel free to call Tech Support at 1-800-736-8625 or support@camavision.com