By: Stan Moellers

Agricultural Assessments in Iowa should be relatively simple with the State of Iowa providing many of the things necessary to set values correctly.

This article is written to assist assessors in getting the proper data and to assist in developing the proper workflows to set your values after receiving the 2019 Ag Productivity Values.

- Update Land Use Layers in GIS

- Internal procedure completed using your GIS

- Physical review

- Aerial Photography

- Update Soils Information from NRCS

- Information available around October 1, 2018

- Web Soil Survey

- Download and compare soils to Soils Tables in Vanguard

- Update Soil Adjustments

- Average Tillable CSRS

- Rent Adjustments

- Ag Buildings

- New construction

- Building Removed

- Base Year Depreciation

- Update Ag Factor

- Final Values

- Import all soils information from GIS

- Update Rate per CSR

- Revaluation

- Partial Exempt Values

- Land Exemptions

- Forest Reserve

- Native Prairie

- Etc.

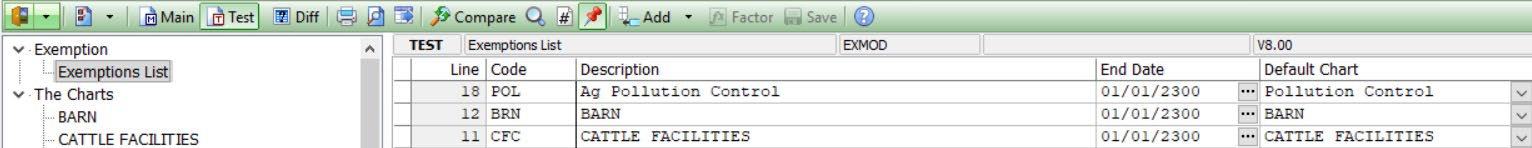

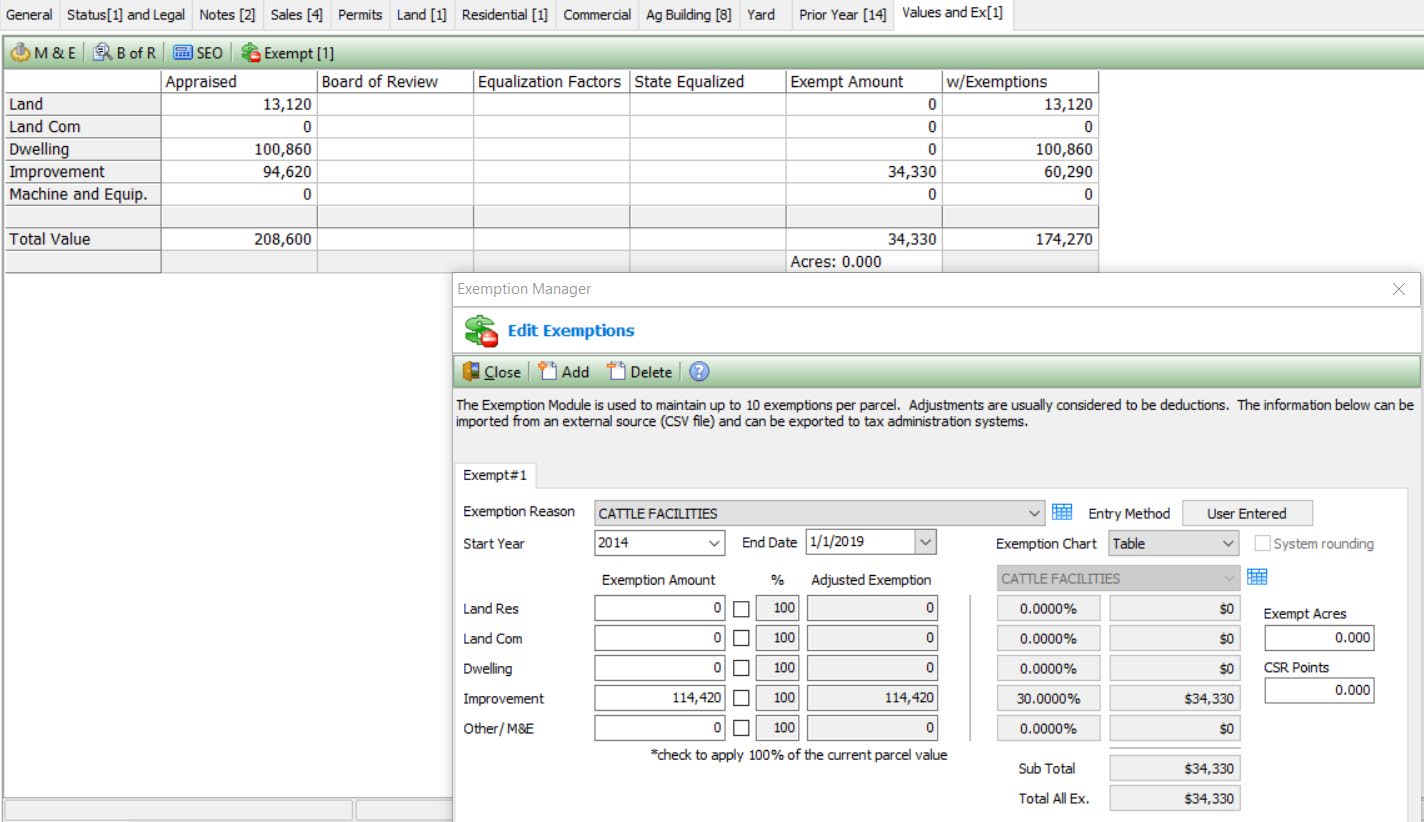

- Building Exemptions

- Pollution Control

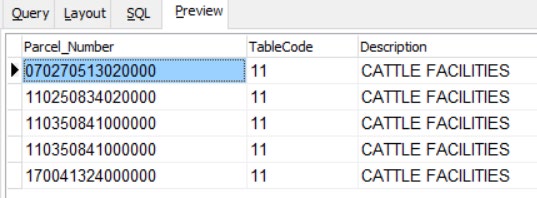

- Livestock Facilities

- Land Exemptions

Update Soils Information

Web Soil Survey ( websoilsurvey.nrcs.usda.gov/app/WebSoilSurvey.aspx )

Click on:

Go to:

Download Data from: ![]()

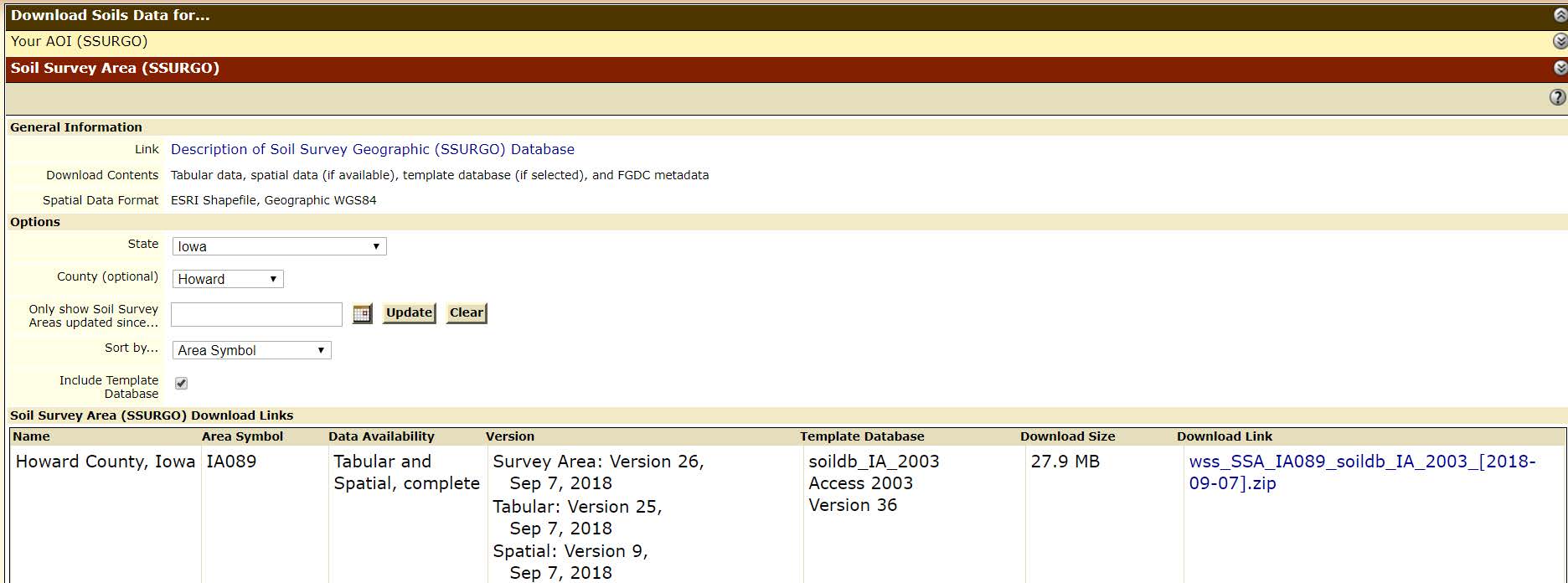

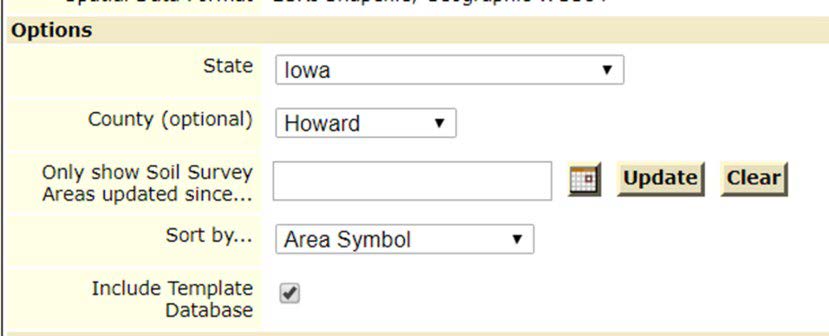

You will get to a screen that looks like this, select State and County

Click on the Download link:

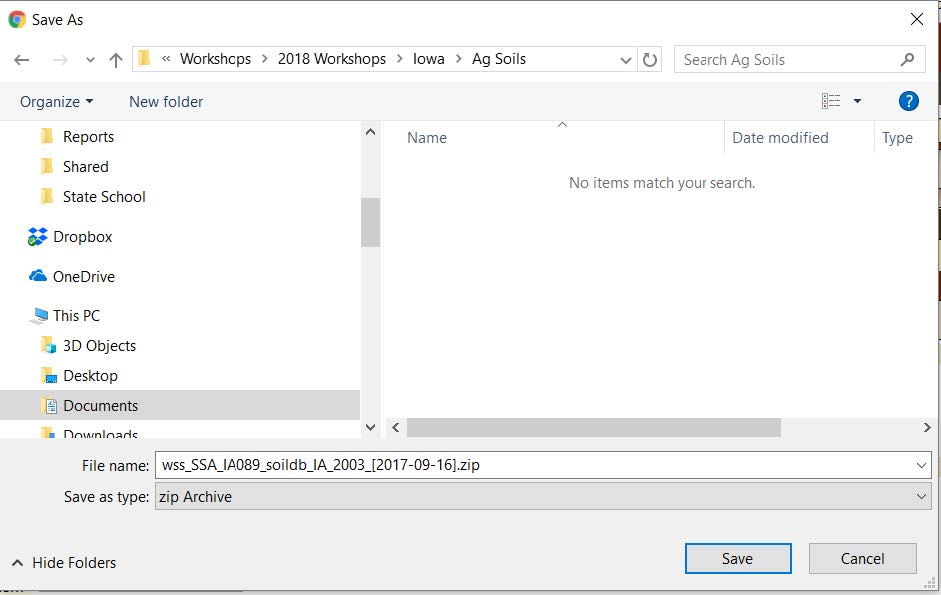

You will be asked where to save the file

The downloaded file will be zipped.

Unzip the file.

There will be 2 folders: Spatial and Tabular. There will be a file in the Tabular Folder named MapUnit.txt which you will import into Excel using the Import function.

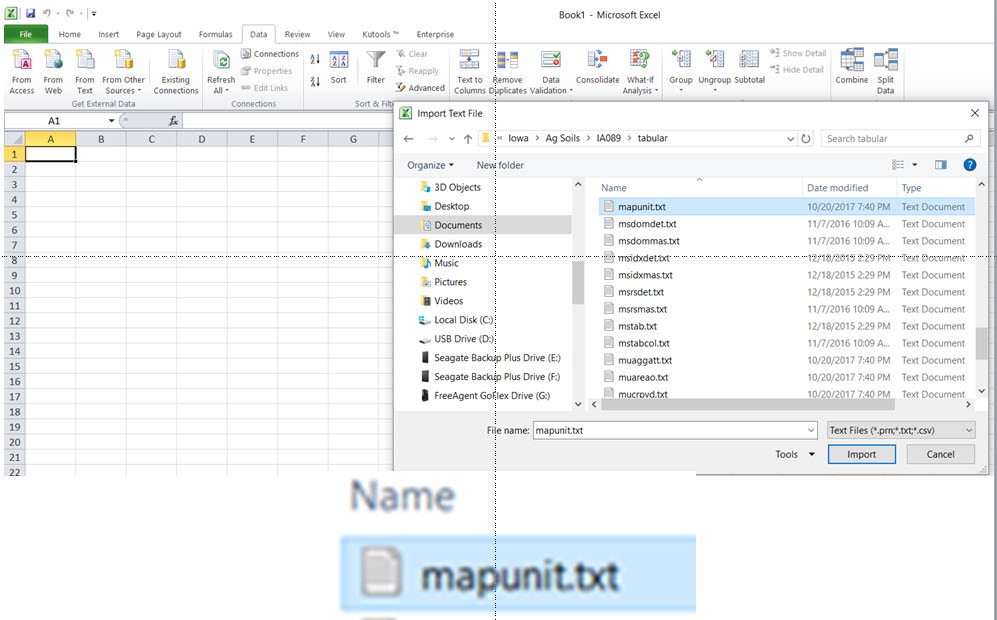

Open Excel:

Go to the Data Tab

Click on:

Import data from Text selecting the mapunit.txt file from the Tabular Folder.

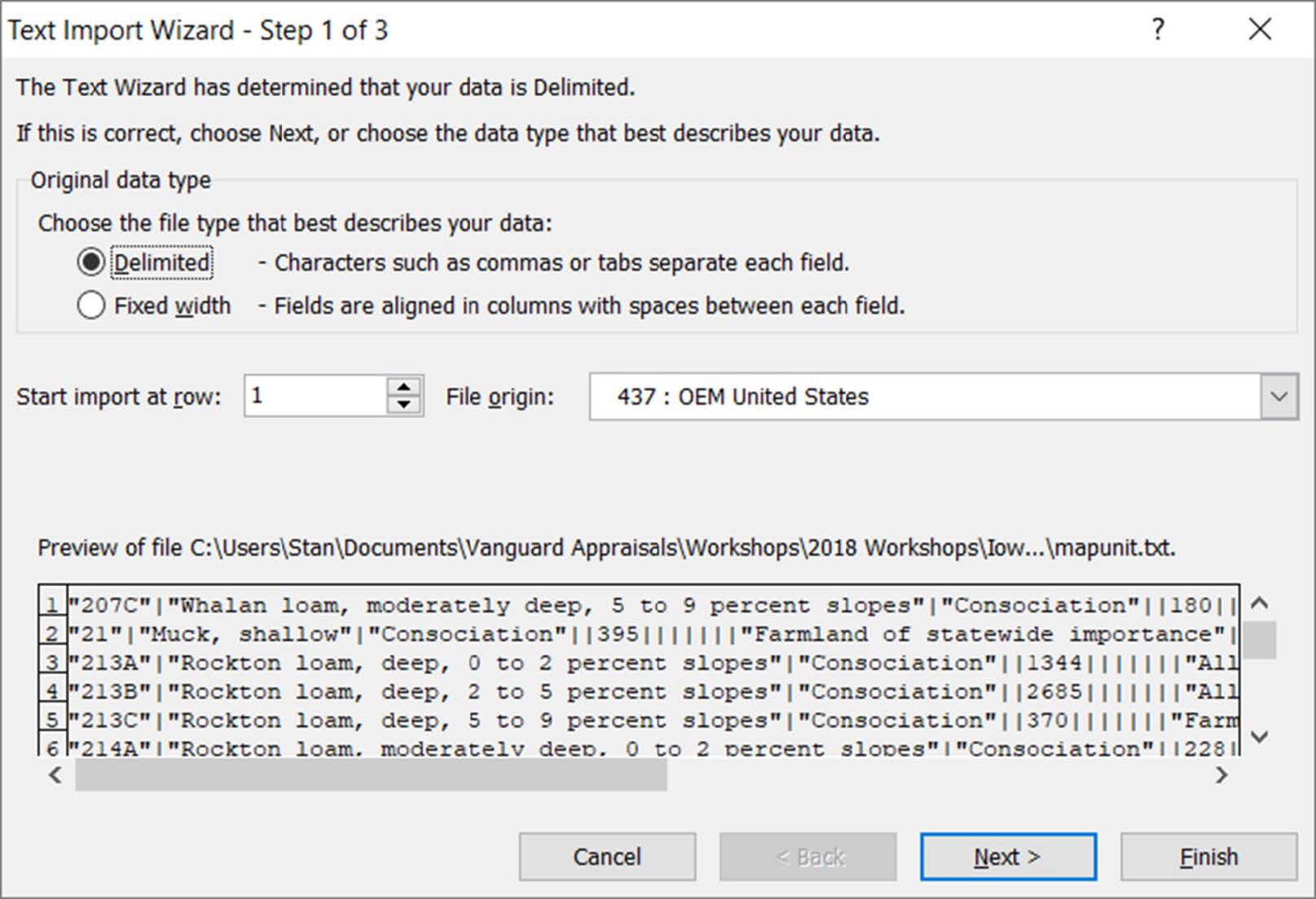

Using the Text Import Wizard you will import this file into an Excel Spreadsheet

Click Next

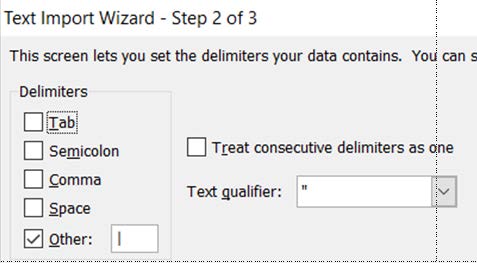

Change the Text Delimiter to other

Enter | (pipe)

Click Next

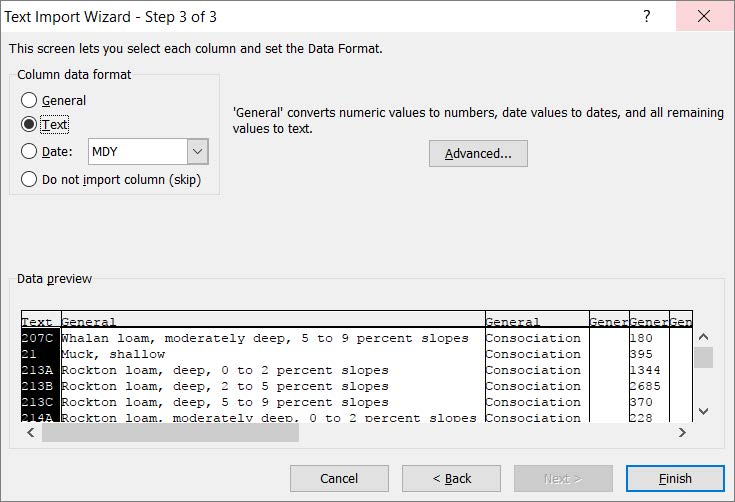

Change Column A from General to Text. Failing to do so may give you some strange soil symbols.

Click Finish

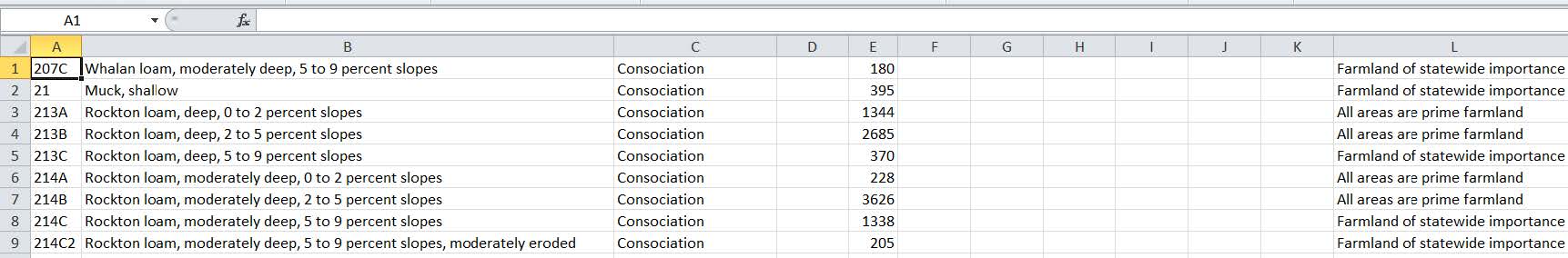

You will get a spreadsheet with many extra columns.

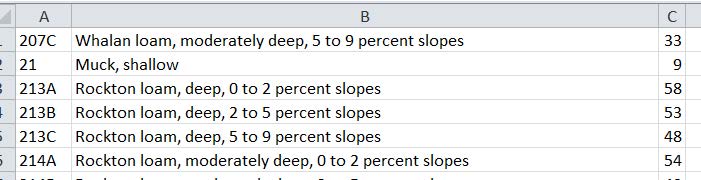

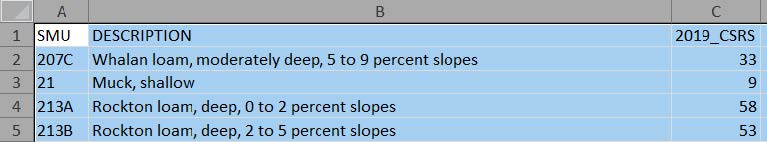

Delete all Columns except A, B and R resulting in a spreadsheet looking like this.

To help you better understand the Spreadsheet insert a row on top.

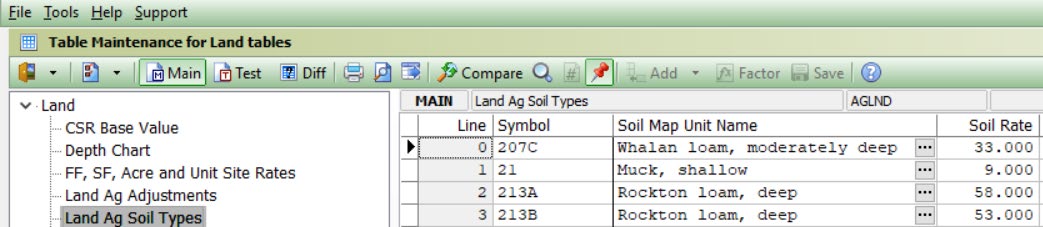

Compare this list to CAMAvision Land / Land Ag Soil Types.

Update any Rate Changes and New Soils in the NRCS file. You may need to update Ag Soils Layer in your GIS, but not always necessary, dependent on number of changes and new soils.

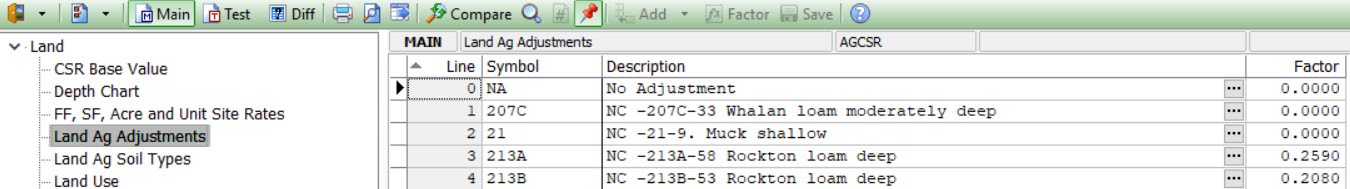

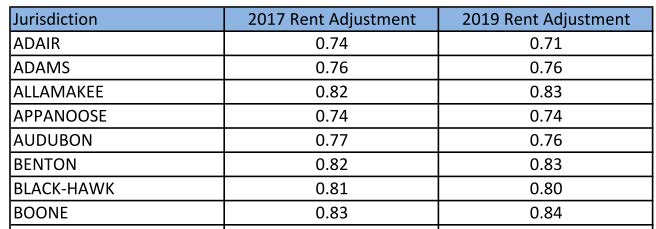

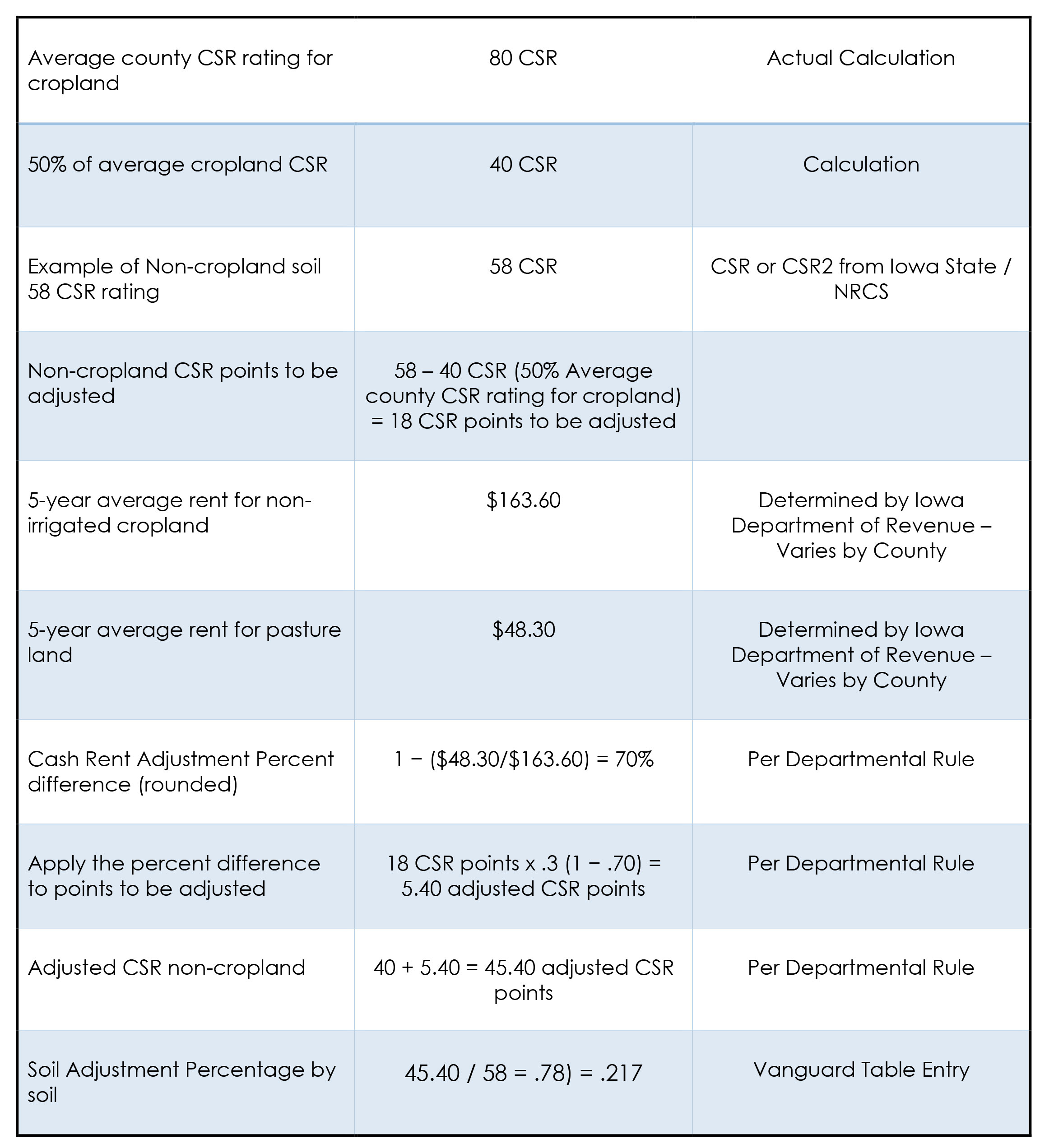

UPDATE Ag Land Adjustments may need to be updated if soil rates rent adjustments or average tillable CSRS change.

Rent Adjustments for 2019 Assessments are available at tax.iowa.gov/agriculture-adjustment-rule-713.

Average Tillable CSRs typically will not change, but always the possibility.

In this example average tillable would be 79 (Total CSR Points divided by Total Acres rounded to the nearest whole number). The base CSR would be 79 x .50 or 39 (Round down).

Ag Land Adjustment Calculations

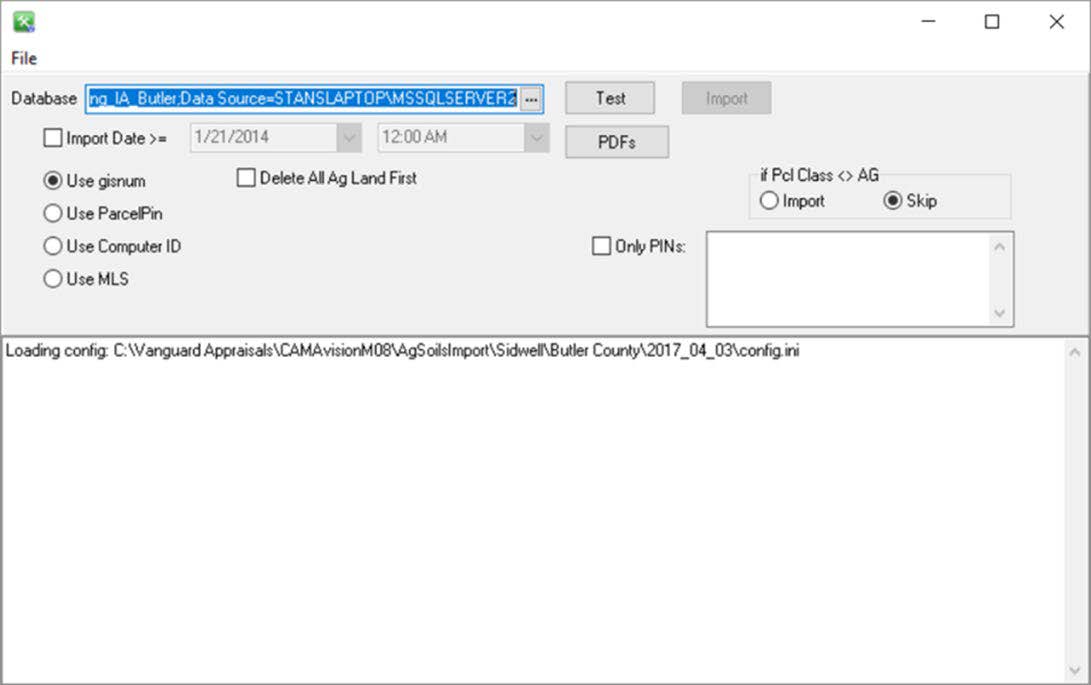

With all of your land tables updated it is time to Import Ag Soils from your GIS software.

It is highly suggested that you do a full import for 2019 Values which helps to catch any errors or changes in GIS.

Building Update

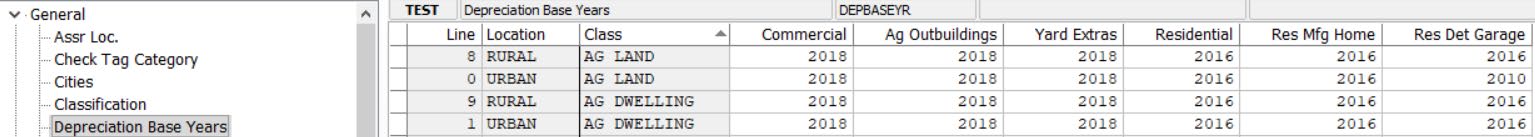

Update Base Year

General Tables

Depreciation Base Years

Update all of the agricultural classed buildings to 2018 base year. Commercial, Ag Outbuildings, Yard Extras.

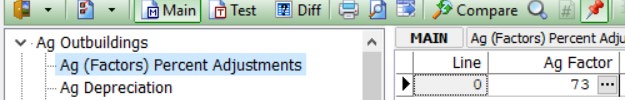

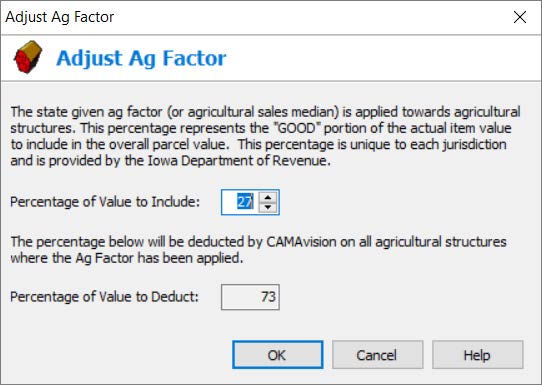

Update Ag Building Factor

Ag Factor is typically supplied by the Department of Revenue.

Department of Revenue supplies you with the value to include.

Round to nearest whole percentage.

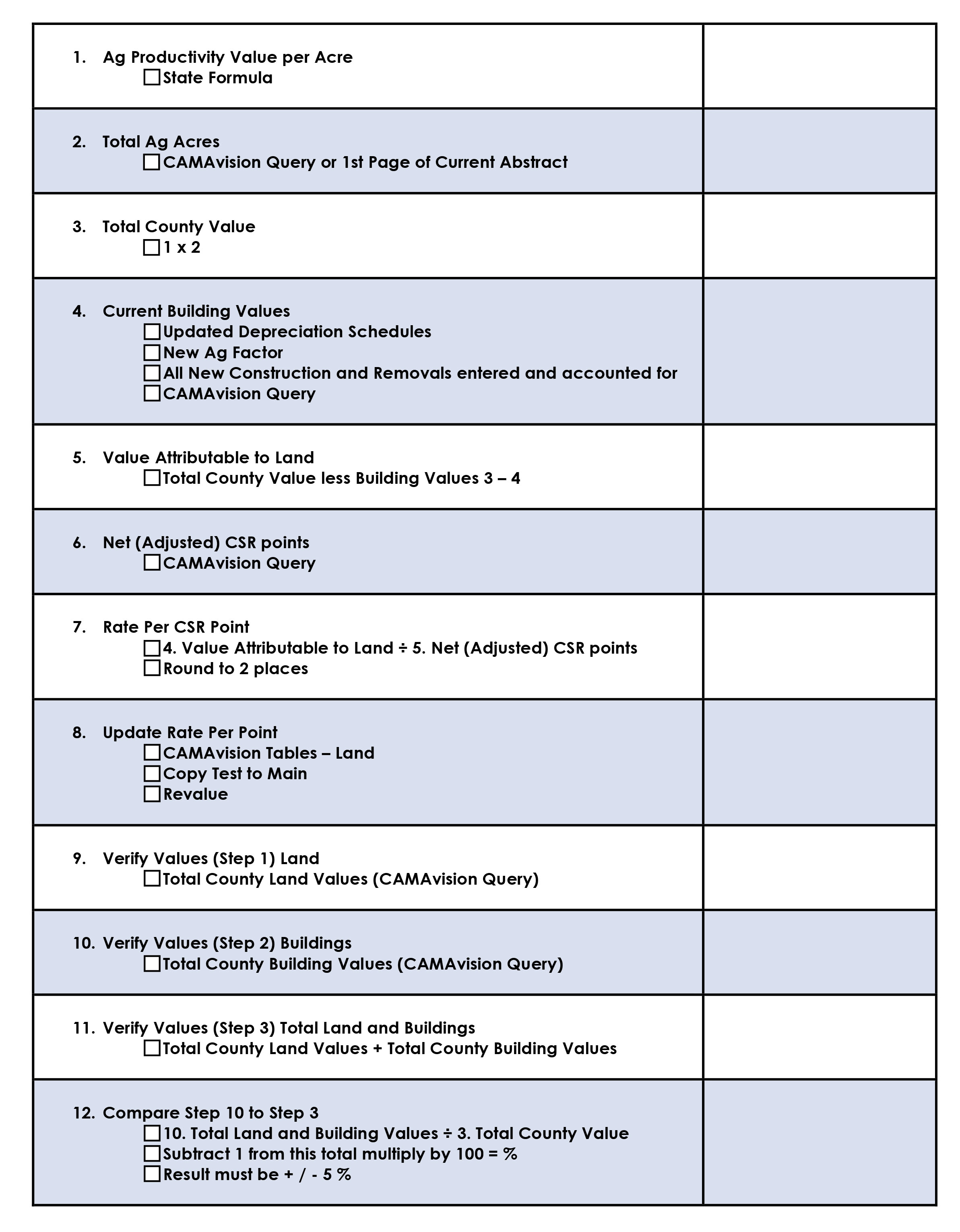

Final Values – Update Land CSR Rate per Point and Review

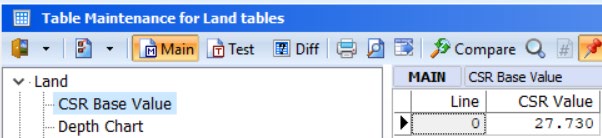

Update CSR Base Value – Rate per CSR Point

Partial Exempt Values

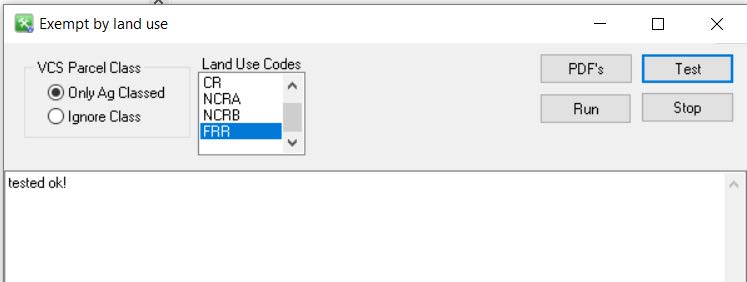

Procedure will update / create but will not delete existing exemptions base on Land Use Codes

Update Building Exemptions

After updating new deprecation and Ag Factor building will need to be updated manually.

Values should be ready for 2019 notices to be mailed.

As always if you have problems or need assistance please give Vanguard a call and we will assist you in the process.